I was enjoying a weekend away with my wife and relaxing far from SAP Ecosystem when a friend told me: ‘Do you know that SAP bought Qualtrics for $8 billion?’. At the beginning I was not surprise. It is not the first time SAP acquire a new company. This is the 69th acquisition after big names as Ariba, SuccessFactors, Sybase, BusinnesObjects, etc. (if you are curious the SAP entry on Wikipedia has the full list of acquisitions over the years). I did a similar post back in 2016 when SAP acquired PLAT.ONE.

What really surprised me was the total costs of the operation. SAP will pay $8 billion to complete the operation. The only time SAP payed more was for acquiring Concur in 2014 when it payed $8,3 billion. Considering this the operation has to be important but being honest, I had no clue who Qualtrics was and what was its business… Lets take a closer look on Qualtrics!

Who the hell is Qualtrics?

Qualtrics was founded in 2002 by 4 patners: Scott M. Smith, Ryan Smith, Jared Smith and Stuart Orgill. If you are curious, Ryan and Jared are brothers while Scott is their father. The HQ are in Provo ad Seattle. For those of you who doesn’t know where is Provo just say that is close to Salt Lake City by the Utah Lake. Anyway the core business of Qualtrics was software related to collecting and analyzing data for market research, customer satisfaction and loyalty, employee evaluations, etc. They currenlt have about 1,300 employees on different locations around the world.

Basically Qualtrics is a company that produces PaaS software. Most of the sales are from subscriptions while they also generates revenue from research on demand and professional services. The following video shows how Qualtrics works:

The interesting thing is that Qualtrics was getting ready for its IPO. So basically SAP acquired the company before the company was set to go public. Paying $8 billion for this company right before the IPO? I think I’m missing something but the deal seams at least risky… The company was expecting to sell 20,5 million shares for $18 to $21 so the total operation would go for $485 million. Meanwhile the valuation would be between $3,9 billion to $4,5 billion.

Right now Qualtric’s numbers seem pretty solid and they have more than 9,000 customers including Microsoft, Kellogg, Master Card, Under Armour, etc.

What SAP will do with Qualtrics?

Time will say it but I think it is pretty clear that SAP acquired Qualtrics in order to include its services and applications in the SAP Cloud portfolio. SAP is increasing its effort in the Cloud releasing old solutions that were available On-Premise and releasing new solutions that are available only on their Cloud. For example, SAP Analytics Cloud is a solution that comes from the old times (SAP BusinessObjects) with a new flavor and features that are not included in the On-Premise software.

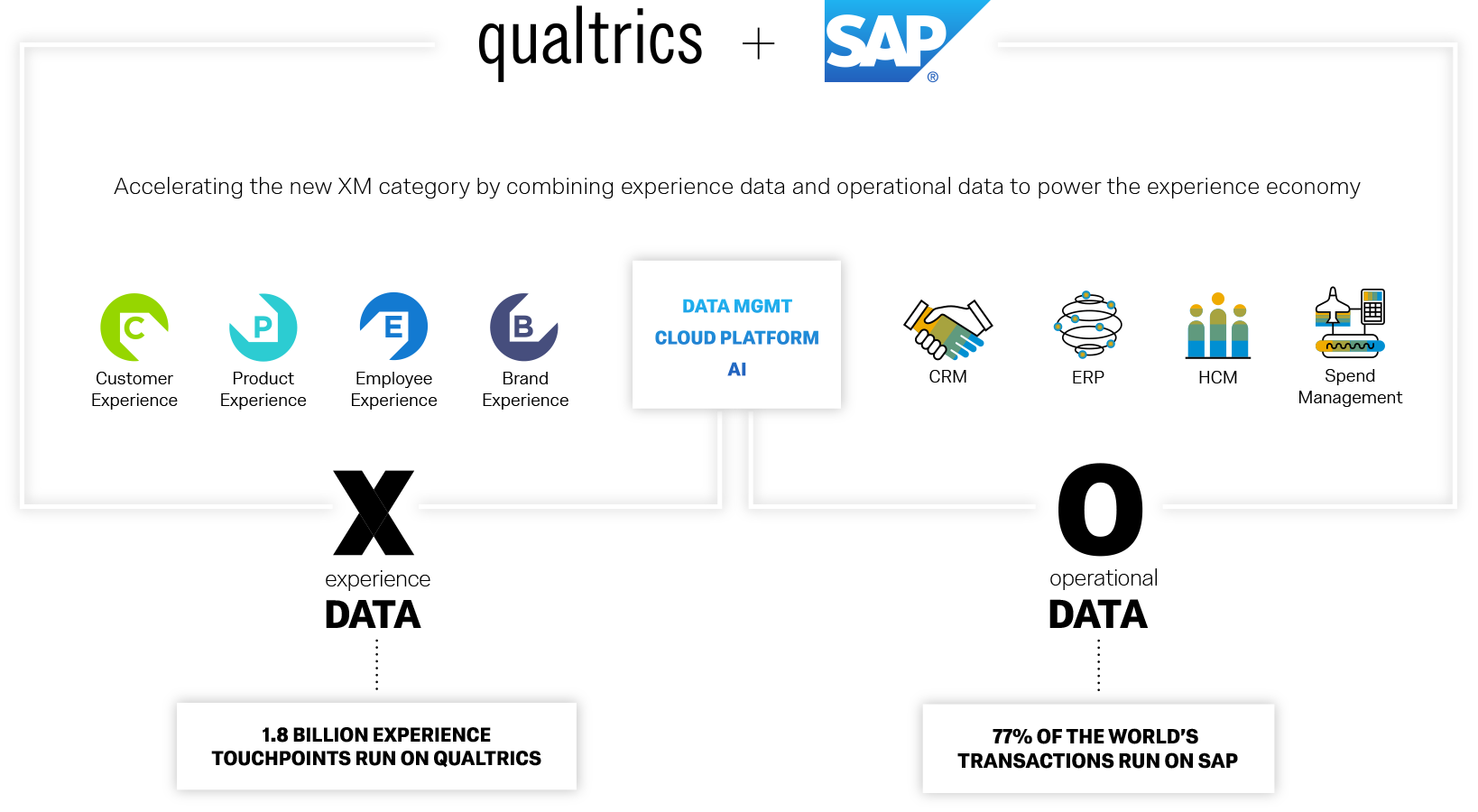

Right now SAP and Quantrics released a the web XOData about what is their idea about the new acquisition. Basically XOData is the Experience Data (X-Data) and the Operational Data (O-Data). The idea is to merge both data types and create a new XM category:

Bill McDermott and Ryan Smith explain this idea in the following video:

If I have to guess how they will use Qualtrics software I would say that they will probably include a lot of features in the following versions of SAP Analytics Cloud. They can also open a new line of business for survey and research in the Cloud of just keep Qualtrics software as is right now and add it to SAP Cloud Platform. As they explained in the video and in the

XOData web the idea is to get data from both sides (On-Premise and On Cloud) and combine them to expand the possibilities for companies.

I recommend reading the press release if you want to know more about the deal: SAP SE to Acquire Qualtrics International Inc., Sees Experience Management as the Future of Business.

One thought to “SAP to acquire Qualtrics International Inc.”